Newest Emerging CBA

Banking Across Africa

Chaincore is an intelligent core banking platform built to help banks, microfinance institutions, and credit-focused lenders innovate, scale operations, and expand financial access across underserved communities and fast-growing urban economies.

Our Mission

Chaincore is redefining core banking for the underserved.

At Chaincore, we believe financial inclusion starts with smarter banking infrastructure. We’re dedicated to powering the next generation of financial institutions with a platform that’s secure, scalable, and tailored for the unique needs of Africa’s markets, from urban digital banks to rural microfinance agents.

01

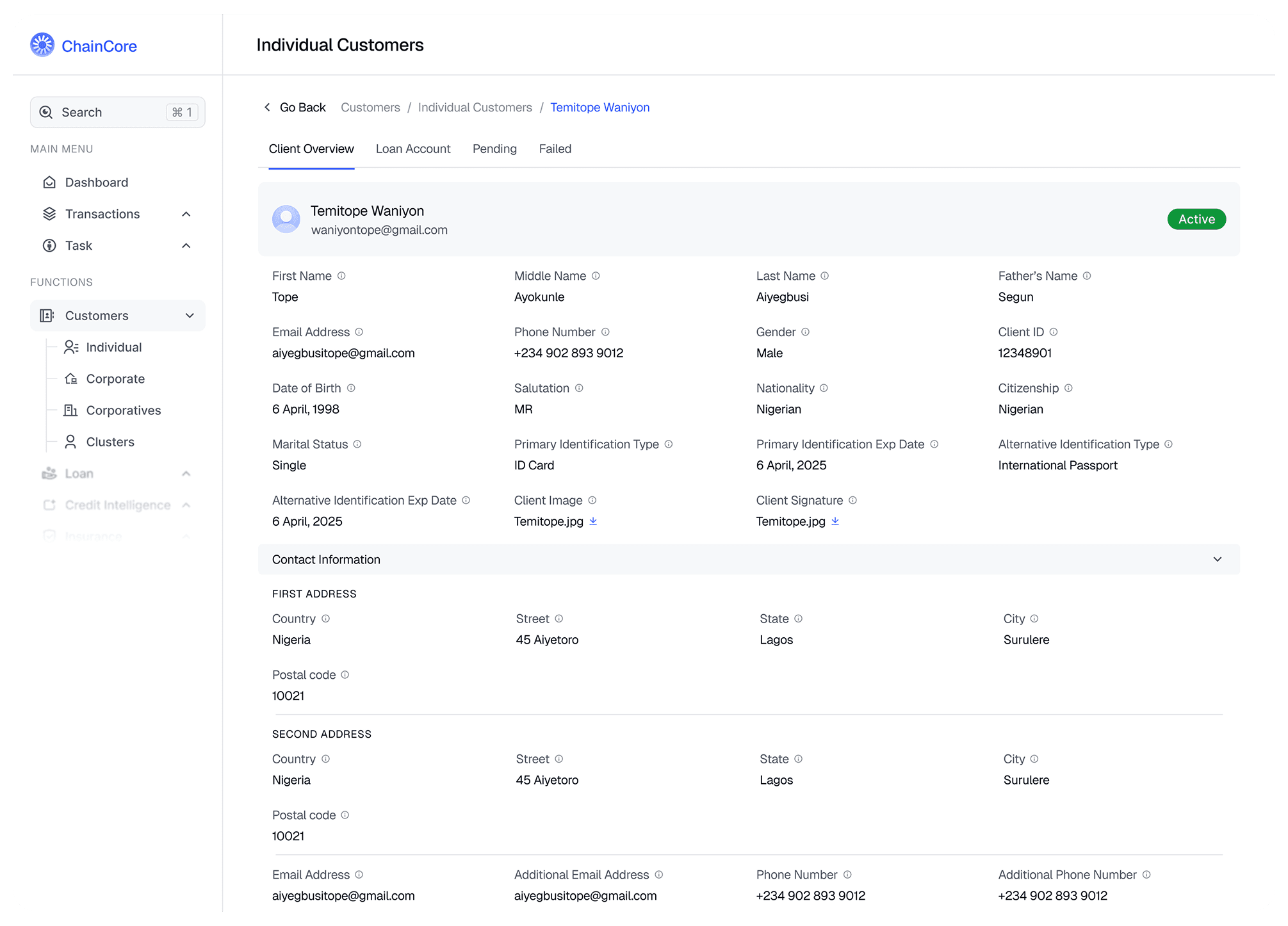

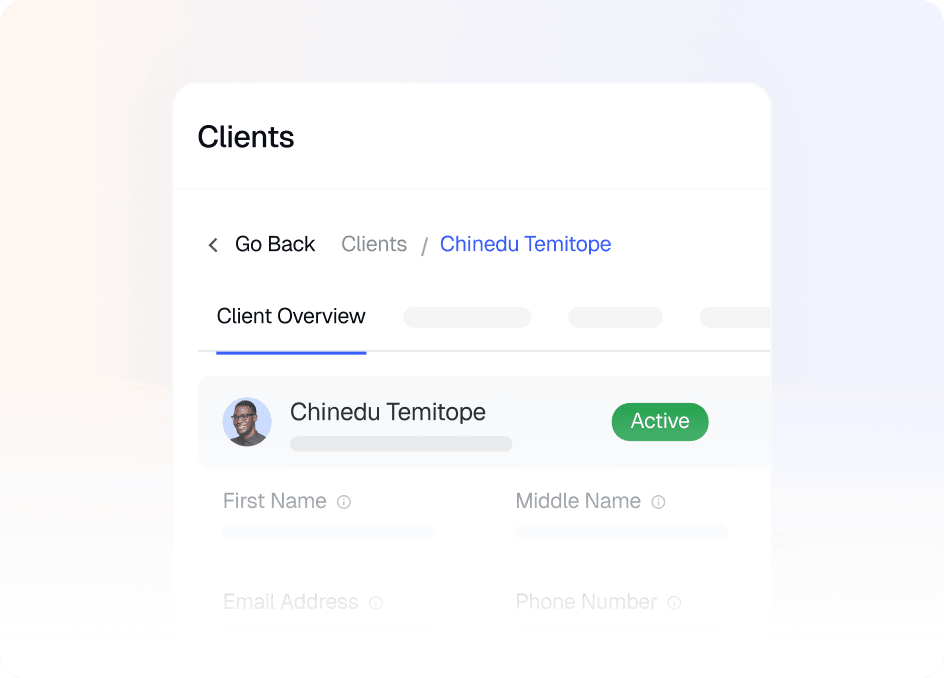

Manage customer accounts with ease

Open, track, and maintain accounts across all channels.

Ensure smooth operations with real-time account control.

02

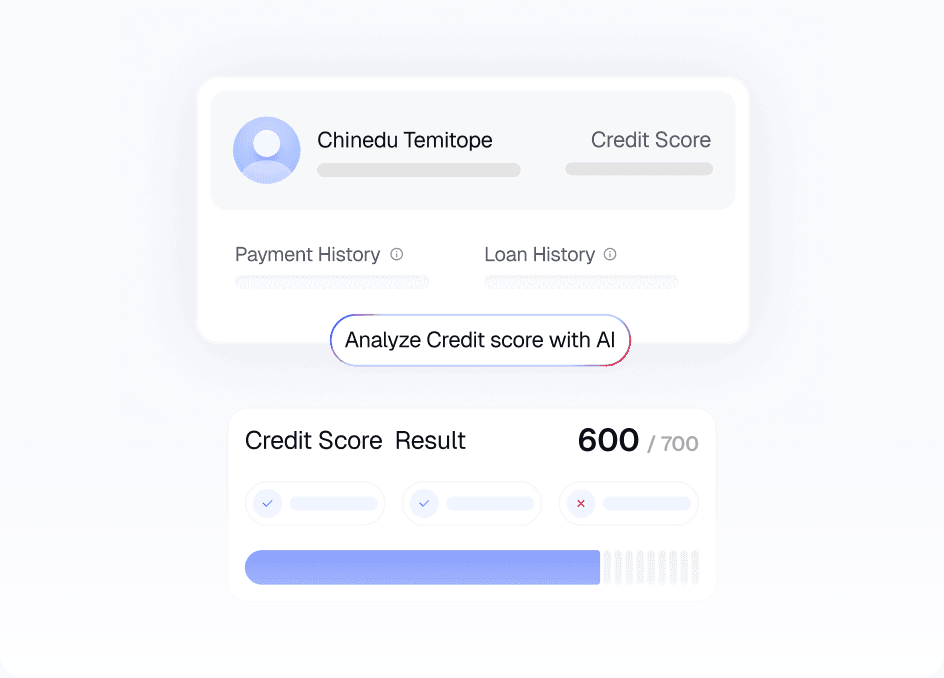

Assess credit risk using AI-driven insights

Analyze behavioral and financial data instantly.

Make smarter, faster lending decisions with confidence.

03

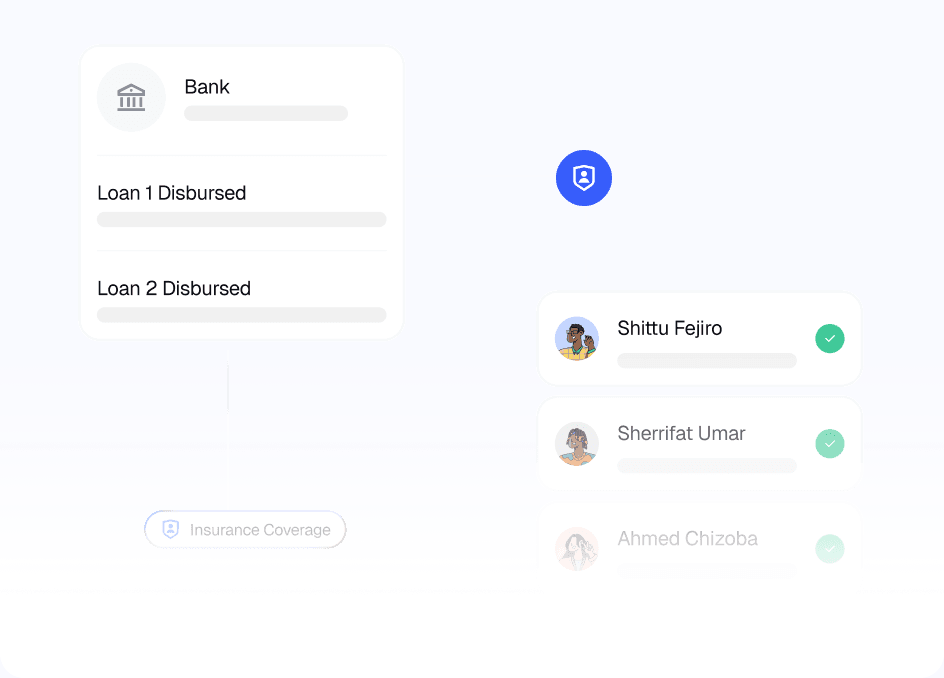

Disburse loans with built-in insurance coverage

Protect borrowers and lenders with embedded coverage.

Minimize risk while expanding credit access at scale.

04

Reach underserved and remote communities

Deliver financial services through mobile and agents.

Connect with customers beyond traditional bank reach.

Built-In Tools

Purpose-Built Features for African Financial Institutions

Pre-integrated solutions for faster, smarter operations.

AI-Powered Credit Scoring

Make faster, smarter lending decisions using behavioral and alternative data, even for first-time borrowers.

Modern Core Banking, Simplified

Manage accounts, loans, ledgers, and compliance with a modern, secure platform built for African financial institutions.

Agent Toolkit & Offline Access

Onboard customers in rural areas through agents and field officers, with offline-first capabilities for low-connectivity zones.

Embedded Loan Insurance

Reduce defaults with auto-included business insurance on every disbursed loan integrated via API.

Intelligent Reporting & Risk Dashboard

Track credit performance, collections, fraud flags, and real-time repayment risk in a single interface.

Secure & Compliant

Built for evolving regulatory environments, with security and compliance considerations integrated across the platform.

Who It's Built For

Empowering Institutions Driving Financial Access

From regulated banks to digital-first fintechs, Chaincore is built to power organizations focused on scale, innovation, and inclusion across Africa.

Microfinance Banks

Modernize operations, expand rural lending, reduce NPLs, and serve millions through agent networks.

Lending Firms & Cooperatives

De-risk informal lending with embedded insurance and AI-driven scoring.

Digital Neo Banks & Fintechs

Plug into Chaincore’s APIs to launch loan products fast with scoring, ledgers, and disbursement logic out-of-the-box.

Government & Development Partners

Deploy large-scale financial inclusion initiatives with rural reach and traceable performance data.

Built-In Tools

Trusted Partners

& Integrations

Trusted by leading microfinance institutions, backed by industry veterans, and integrated with Nigeria’s top insurers.